AMD's Earnings: Smoke and Mirrors?

Another earnings week, another round of corporate theatrics. Palantir, AMD, McDonald's... they all step up to the plate, give us the song and dance, and we're supposed to just eat it up? Let's be real.

Palantir's up first, bragging about hitting $1 billion in revenue. Good for them. Analysts are creaming their jeans over 60% year-over-year growth. Citi's Tyler Radke is seeing "positive checks" across government and commercial sectors. Okay, Tyler. But what does that actually mean for the average person struggling to pay rent? Are Palantir's algorithms making the world a better place, or just helping the powerful get more powerful? I suspect the latter.

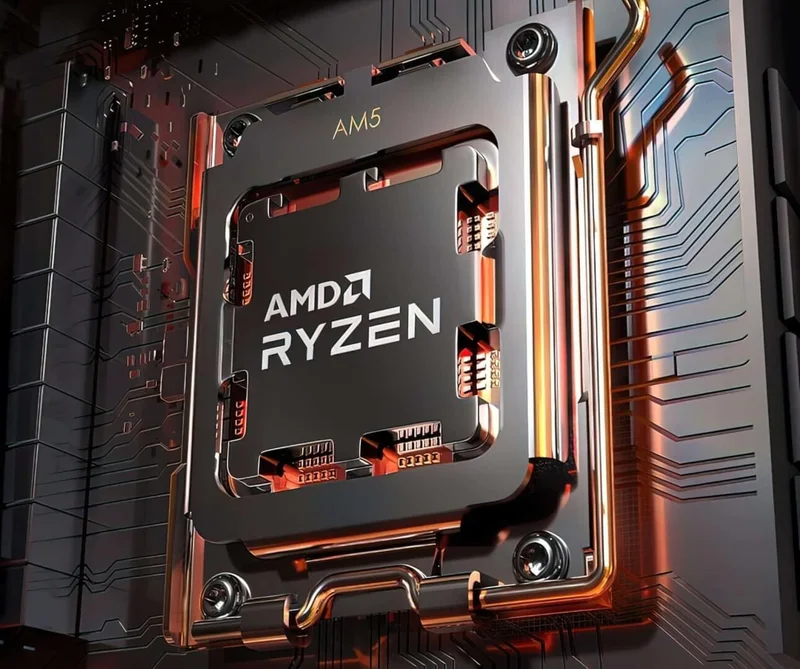

The Chip Dip

Then there's AMD. Oh, AMD. Last quarter, they "beat" revenue expectations but still managed to deliver weaker-than-expected earnings. Translation: they sold a lot of stuff, but didn't make as much money as they wanted. Now, UBS analyst Timothy Arcuri is predicting a "strong report," driven by server and client CPU strength. He's even throwing around numbers like "$1.7B" for data center GPU revenue. According to Earnings playbook: AMD and Palantir set to report in another busy week, AMD was set to report during a busy earnings week.

Give me a break. It's all just numbers until they aren't.

AMD averages a 1.6% drop on earnings days, according to Bespoke. Let's see if history repeats itself, shall we?

And SMCI is expected to report with them. So what?

Lies, Damn Lies, and Corporate Earnings

Pfizer's in the mix too, expected to report a 40% year-over-year earnings decline. Bernstein analyst Courtney Breen sees "the highest risk for a miss." Well, duh. After all the COVID profiteering, the party's gotta end sometime, right? But don't worry, they hiked their 2025 earnings outlook last quarter thanks to cost cuts. "Cost cuts," of course, being code for "firing a bunch of people."

Uber's also on deck, expected to see earnings drop 40% year-over-year. BofA is hyping up membership benefits as a driver for earnings. More loyalty programs? More ways to trap customers in their ecosystem? No thanks.

McDonald's? Forecast to report a slight year-over-year earnings increase. Barclays is keeping an eye on their value offerings. Because in this economy, who isn't pinching pennies and hitting up the Golden Arches? It's a vicious cycle.

Robinhood? Expected to have soared 214%. Goldman expects a beat on revenue and net interest income. The stock fell after two of those releases. Color me surprised.

The Illusion of Growth

It's all a carefully constructed illusion. Analysts make predictions, companies release carefully worded statements, and the stock market reacts accordingly. But behind the numbers, behind the jargon, what's actually happening? Are these companies creating real value, or are they just shuffling money around and enriching a select few?

I'm starting to think it's the latter.

I mean, let's be real, none of this really matters to the average joe. Just a bunch of companies patting themselves on the back while the world burns.

So, What's the Real Story?

It's all a rigged game. They pump the numbers, they spin the narrative, and we're all supposed to clap like trained seals. But I ain't buying it. Ain't gonna happen.